The KiwiSaver scheme with real choice

Invest your KiwiSaver balance and ongoing contributions in the companies and exchange-traded funds (ETFs) that matter to you most. It’s your money, your future. Make it yours!

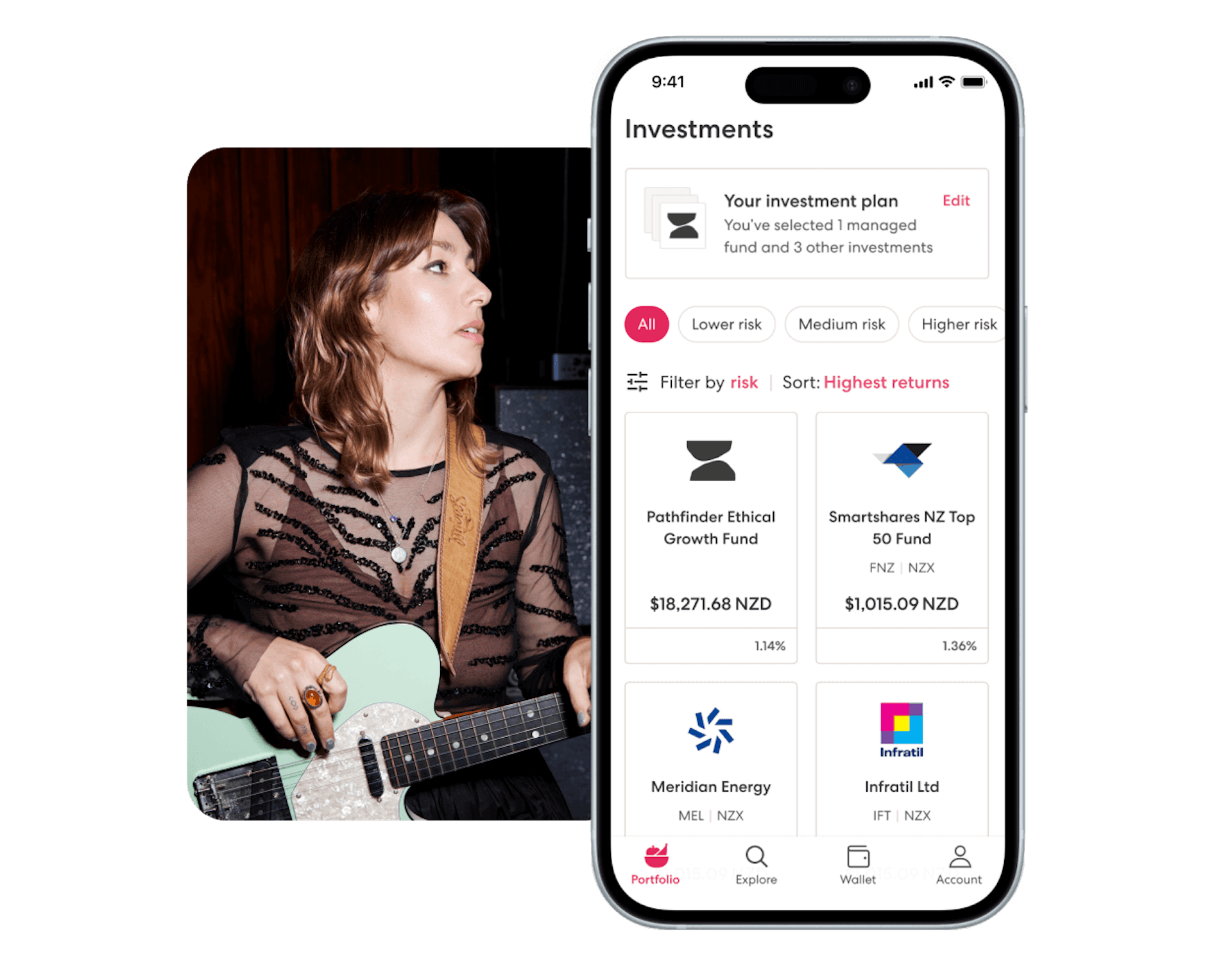

Make it uniquely you

With nearly 100 NZX-listed companies and exchange-traded funds (ETFs) to pick from, you can build a KiwiSaver portfolio that reflects your values—not someone else’s.

You call the shots

Add or remove your picks, or change your base fund, whenever works best for you, wherever you’re at in life. After all, you know you better than anyone else.

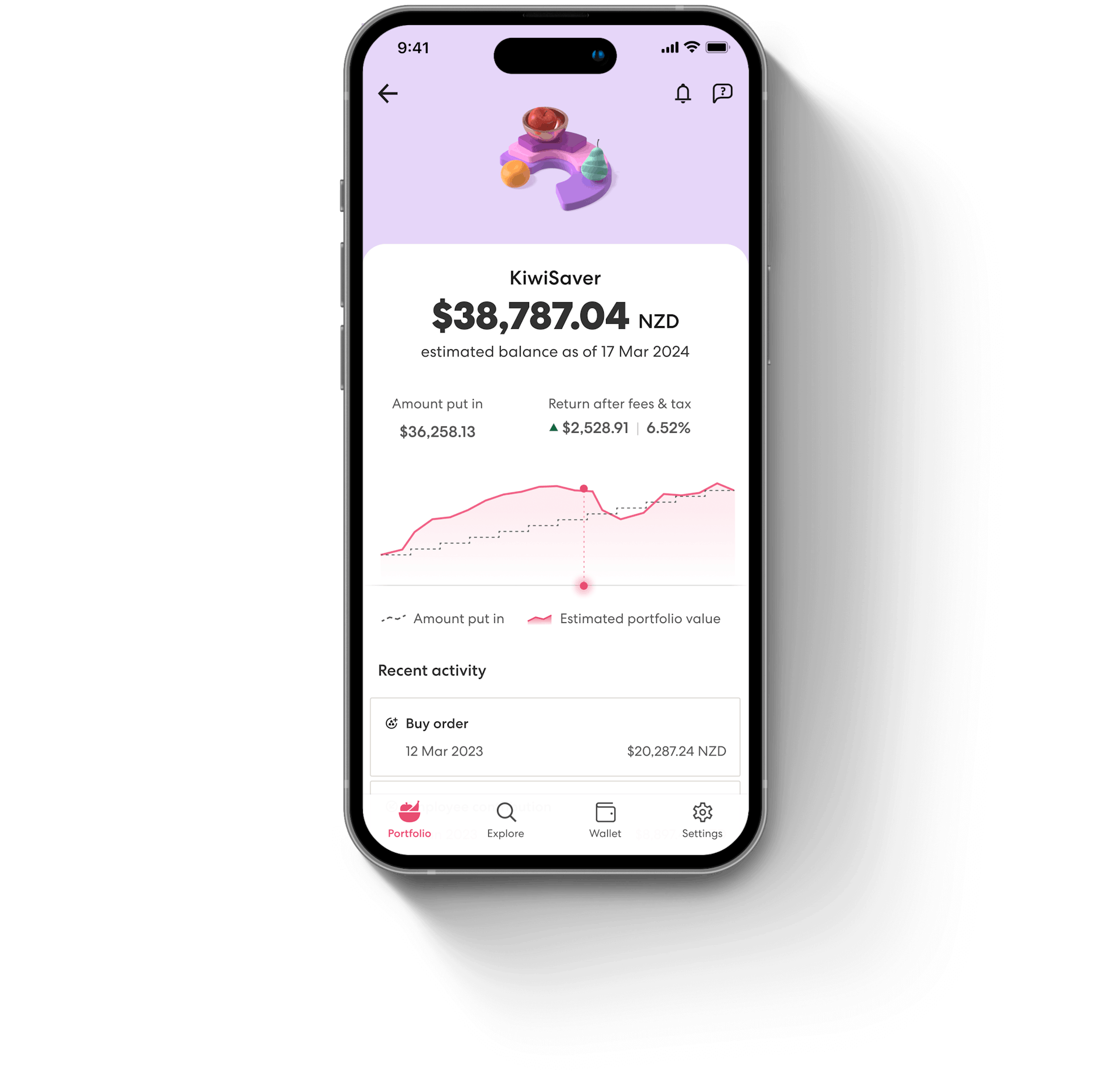

See where every dollar goes

Experience a more transparent KiwiSaver portfolio, with in-depth info about your investments, returns, and transactions.

How the Sharesies KiwiSaver Scheme works

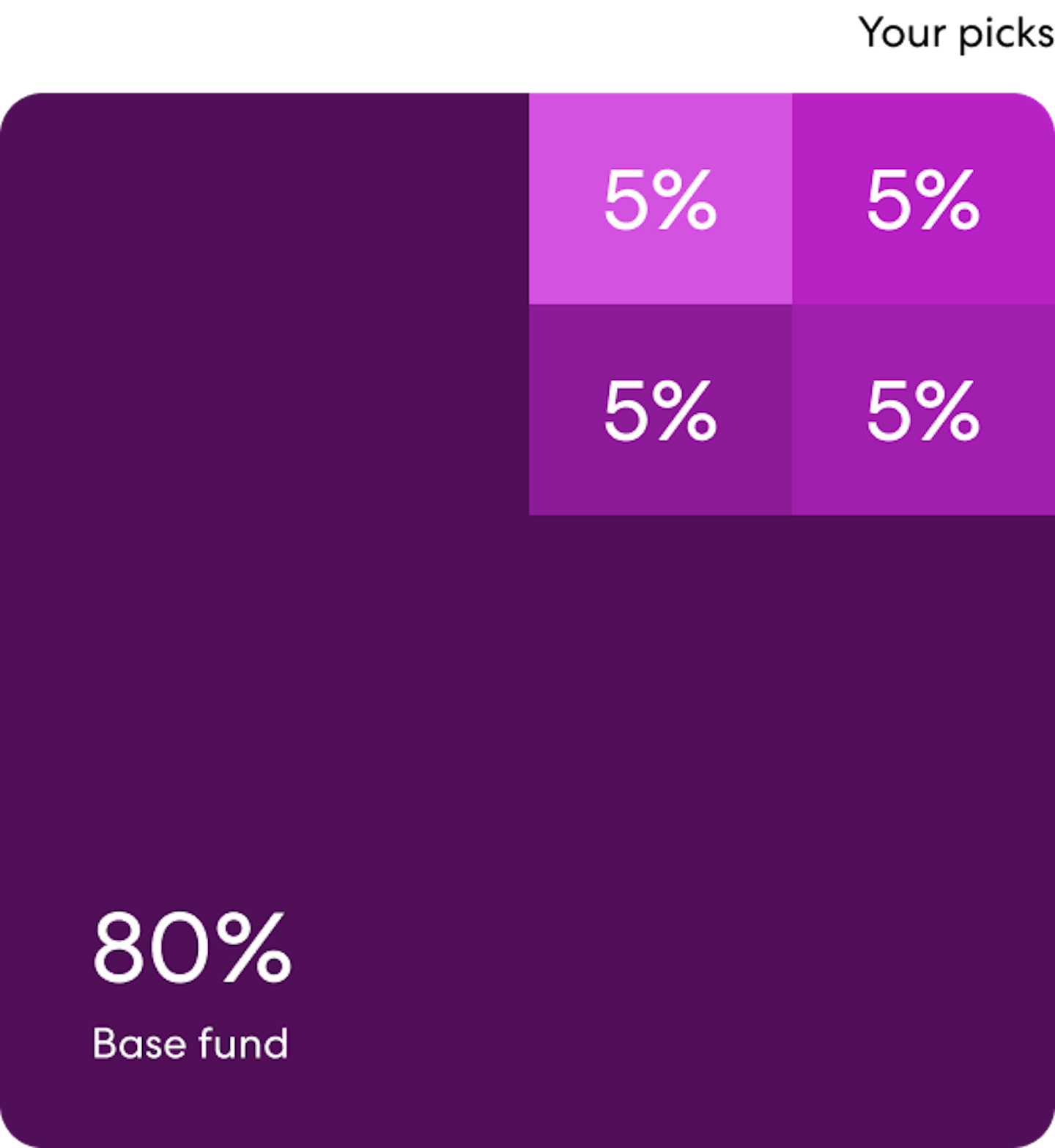

Our Scheme is a bit different to conventional KiwiSaver schemes. We give you the freedom to choose your own investments, with limits to help you manage your portfolio’s risk and diversification.

Start with a plan

Your first step toward a future that’s more you begins with making an investment plan. It tells us how you’d like your KiwiSaver balance and ongoing contributions invested.

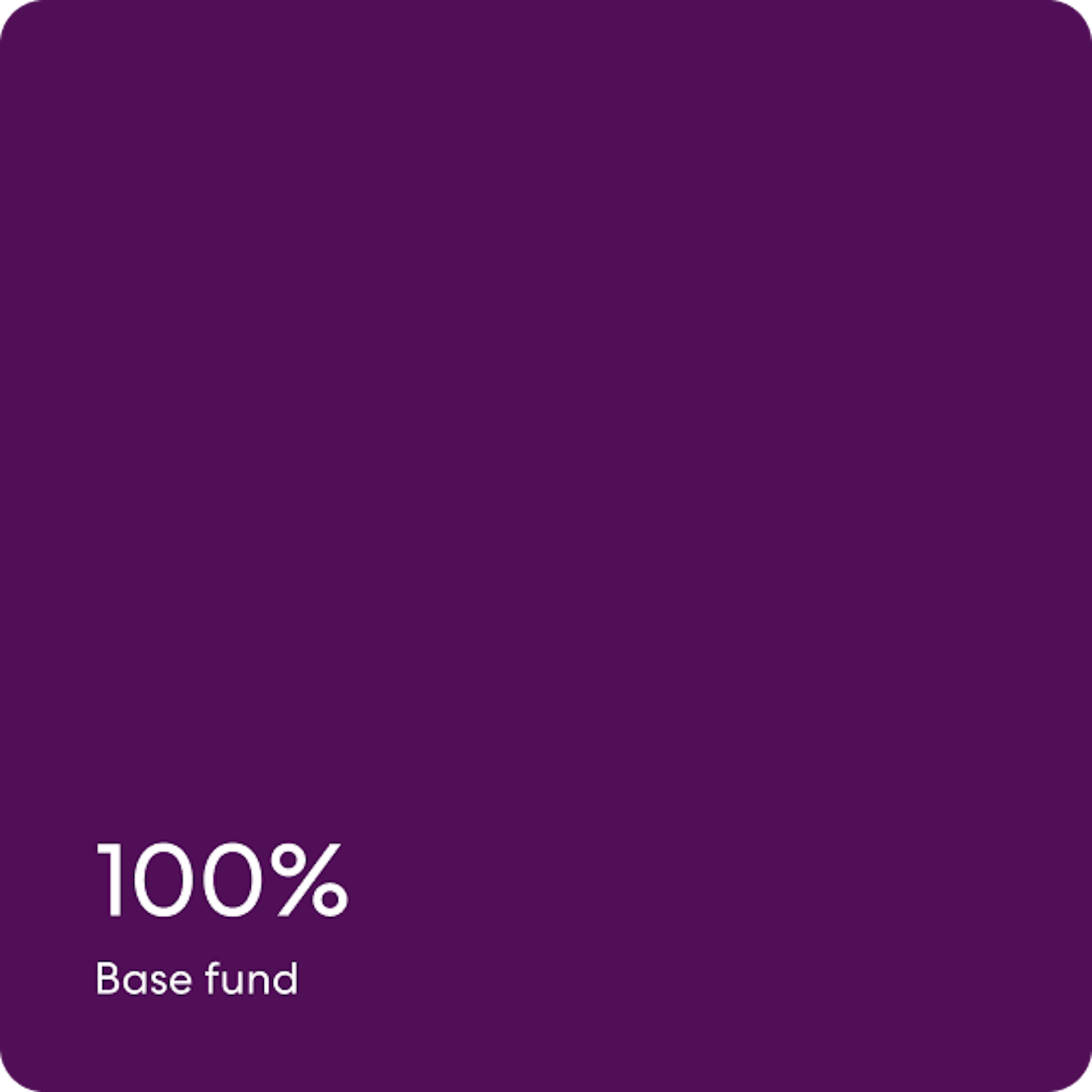

Choose a base fund

You’ve got the choice of six base funds, ranging from a lower-risk conservative fund to a higher-risk aggressive fund. Your base fund can make up your entire investment plan, or you can add your own picks on top.

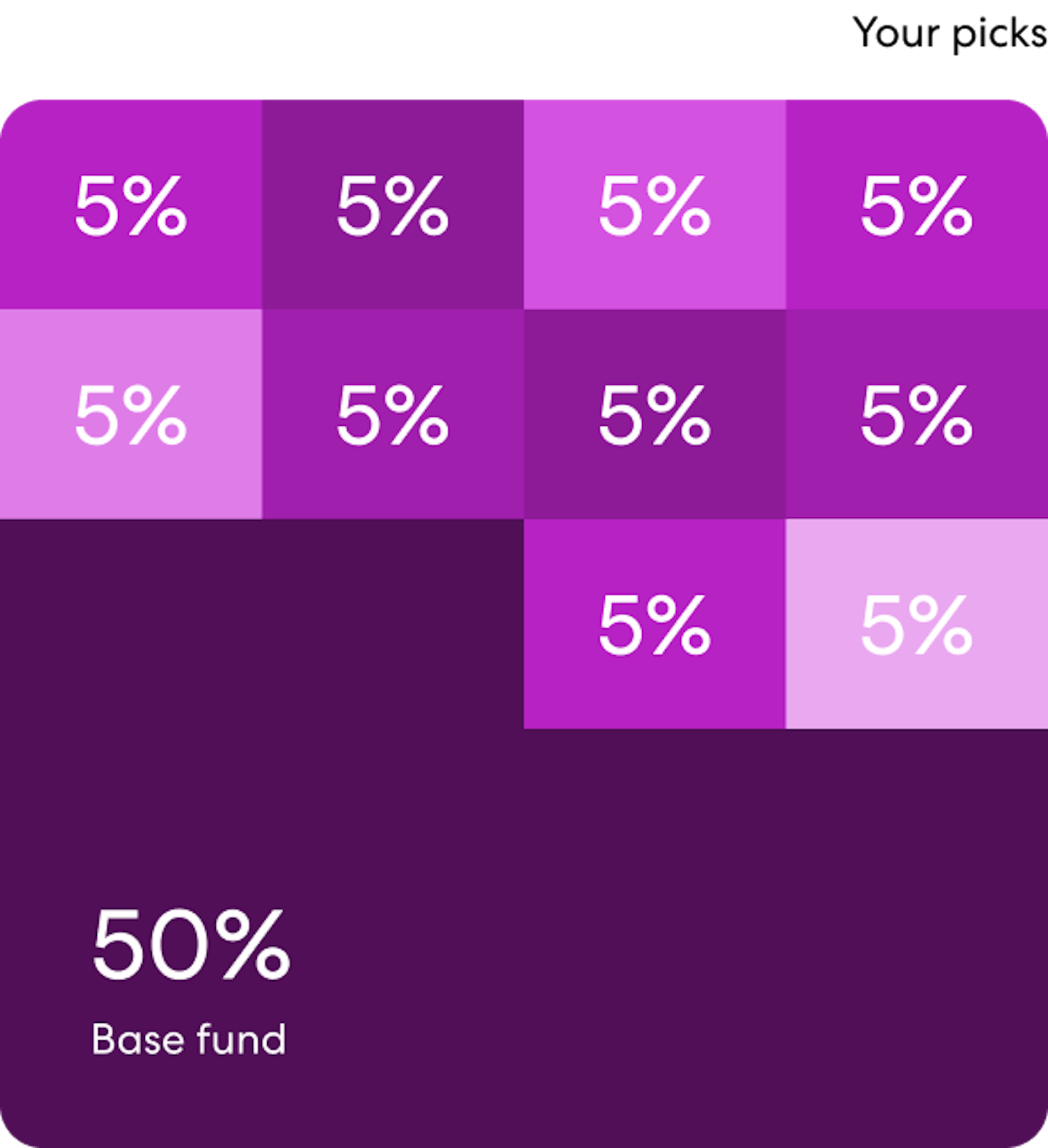

Add your own picks

If you like, you can add your own choice of nearly 100 companies and ETFs listed on the NZX. Up to half of your plan can be allocated into your own picks, to a max of 5% in each pick.

Change as your life changes

Goals, values, or risk appetite change? No worries—you can add or remove picks, or choose a different base fund, whenever you like.

Ready to join?

Joining takes just minutes if you’ve got a Sharesies account and you’re over 18.

Don’t have a Sharesies account? Sign up now

Have a go at making a plan

See what an investment plan that’s as unique as you are could look like. Then, if you’re keen, use it to join straight away—or save it for later.

- Agriculture and fisheries

- Banking and finance

- Bonds and fixed income

- Energy and utilities

- Food and drink

- Healthcare

- Index funds

- Infrastructure

- Manufacturing

- Media

- Mining, oil and gas

- Property

- Responsible

- Retail

- Strategic funds

- Technology

- Tourism

- Transport

Fees

Your fees will flex based on what you pick, and how much you personalise your portfolio.

Documents

Product disclosure statement (PDS), fund updates, reports, statements, and policies.

Tax

We’ll report and pay tax at your prescribed investor rate (PIR) for you. You don’t need to lift a finger!

How to join

You’ll need to have a Sharesies account and be over 18. If you don’t already have an account, sign up now.

- Answer a couple of questions

We’ll ask what you’re planning to use your KiwiSaver balance for, and the kind of funds you’re interested in.

- Make your investment plan

Choose your base fund then, if you like, pick your own choice of self-select investments.

- We’ll take it from there!

It’ll take us about 10 days to transfer your KiwiSaver account, or about five days to get you set up if you’re new to KiwiSaver.

The Payoff

Over six, 20-minute episodes, we bust KiwiSaver myths and get expert tips from Simran Kaur, Mary Holm, Brad Olsen, Petra Bagust, and Pio Terei.

More good stuff on the way

More you, with new self-select investments—including US and Australian shares

More choice, with a greater variety of base funds, and a multi-currency cash fund

More control, with the ability to add multiple base funds to your investment plan

Learn more about KiwiSaver

From getting started to using it for your first home—and beyond!

Your future in one place

Experience a new level of connection with your investments, savings, and KiwiSaver account. Developing your wealth has never felt so personal.