Investor Journeys—Mireia

Mireia shares her experience taking a career break to move to Spain—and how that’s impacted her approach to saving and investing.

Tell us about yourself.

I’m 24 years old, and I’m currently living in Valencia, Spain. I moved here after quitting my job in the public sector. I’ve taken a career break to travel, teach English, and do something totally different. I’m also really passionate about financial education, and got certified in financial advice before I left New Zealand!

What’s your money story?

I’ve always been interested in money, but investing seemed so scary to me. My parents lost a lot of money in the 1987 share market crash, so they had a perception that investing is too risky. It didn’t feel like something I could or should be a part of.

That changed four years ago thanks to online communities like She’s on the Money, Girls that Invest, The Curve, and The One Up Project. Seeing other like-minded women talk openly about money inspired me to learn as much as I could, and empowered me to back myself more.

How did you start investing?

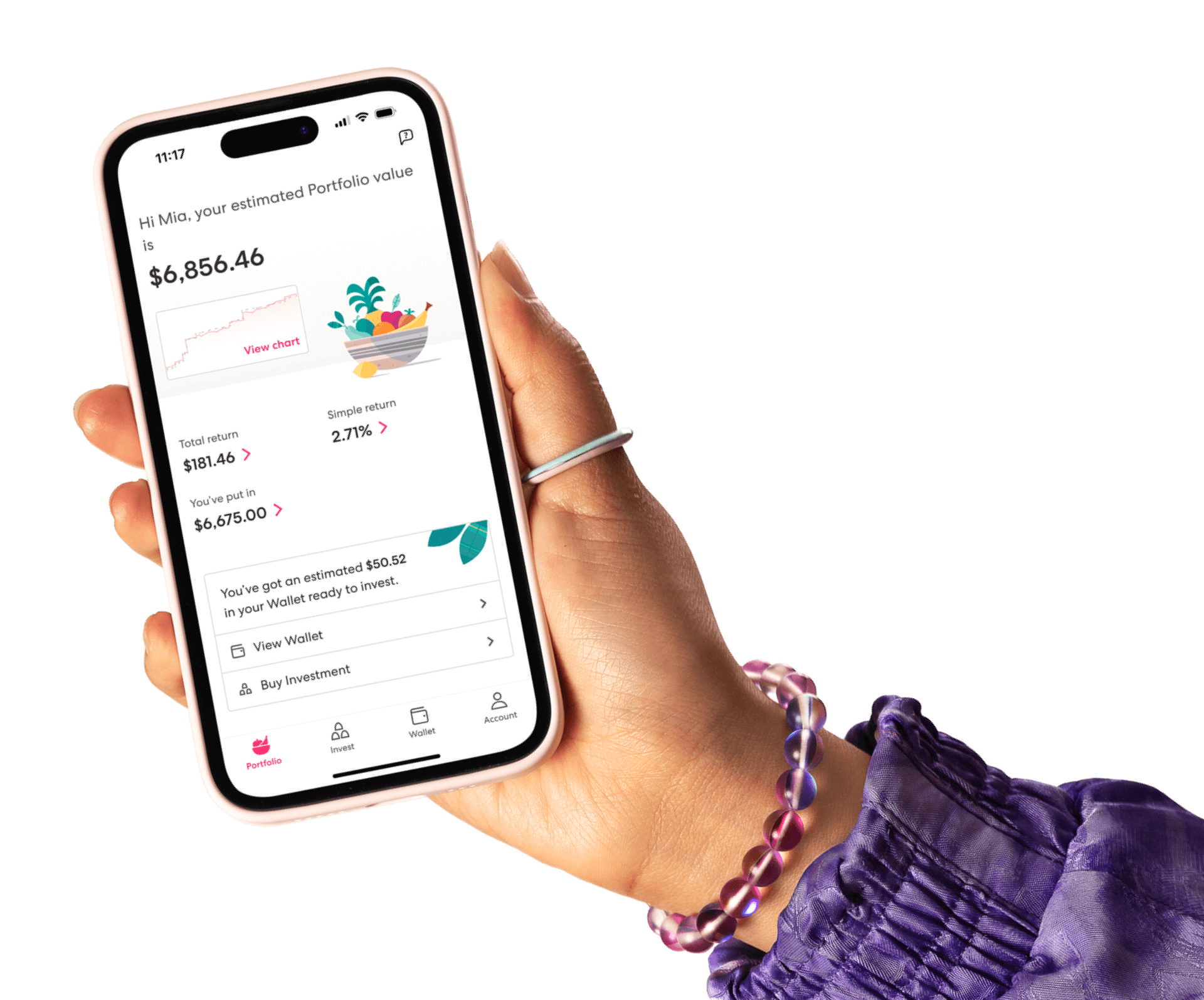

My first investment was through Sharesies, but I stopped for six months after I got scared that I was going to lose money. I took the time to educate myself, and then started again using auto-invest.

Since then, I’ve diversified my investments, knowing that I’m comfortable taking on more risk because I’m younger and have longer to ride out the ups and downs of the share market. I’ve also become more confident, and the amount I invest has kept increasing.

How has your investing changed over time?

When I decided to move overseas, I didn’t want to stop investing, but I knew that I’d have to reduce my investment amount so I could save enough to travel. I managed to hit my savings target early, so any extra money (plus the payout from my job) went straight into Sharesies. I’ve been investing that money for the first year while I’m overseas—so I can keep investing, and still enjoy Spain.

That’s the great thing with investment strategies. It can change at any time to suit your goals, your stage of life, your priorities. It’s about setting up the systems to support you and how you want to live, and then adapting them as your financial situation changes throughout your life.

What are the key things you’ve learnt as an investor so far?

Start with whatever amount you can afford—even a small amount can make a big difference later. Changing my KiwiSaver provider was also a game changer. It made me realise that I have a choice of what I’m investing my money in.

Create strategies that suit you and your situation. I dollar-cost average using auto-invest because it takes the stress out of investing. It’s all automated, so it frees up my time to do other things, like travelling or listening to more finance podcasts. Plus, I’m investing for the long term so I don’t feel like I need to check my portfolio every day.

Money isn’t something that should be kept a secret. I used to ask my colleagues what KiwiSaver provider they were with, and no one wanted to talk about it. I was like, “How do I learn if no one’s sharing their knowledge?” Now I have lots of conversations with my friends and family about investing and KiwiSaver. It’s so important to talk about money openly and remove that fear.

What does growing wealth mean to you?

My investment portfolio on Sharesies is called Mireia Future Sugar Fund, because I see it as money that I’ll get to access in the long term. My dream is to be able to live off the compound returns from my investments. But it’s not about material things—it’s about financial freedom.

Financial freedom is about having choices in life; how and when you want to work, whether you want to travel, spend time with your family, or whatever else. It’s about knowing that you can walk away from any job, relationship, or situation that’s ever compromising your safety or wellbeing.

Now in Spain, I get to dance, eat tapas, learn Spanish, and travel—and it’s financial freedom that’s allowed me to do that.

The people in our Investor Journeys are Sharesies investors. Their stories are actual experiences they’ve had but are not advice, a recommendation, or an opinion by them to invest or to use Sharesies in the manner they have. They’re compensated for their time to record their story.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 600,000 investors