Invest in managed funds

A managed fund spreads your money across a hand-picked group of investments. A fund provider picks the investments based on an investment strategy.

Why invest in managed funds?

They’re hand-picked

The fund provider scrutinises each investment in the fund to meet an investment strategy.

Potential tax benefits

PIE income tax is based on your prescribed investor rate (PIR) rather than your ordinary income tax rate. This means you might pay less tax compared to other investments.

Eggs in multiple baskets

You might have heard the saying ‘don’t put all your eggs in one basket’. When you invest in a managed fund, you own a piece of a bunch of investments, instead of just one company.

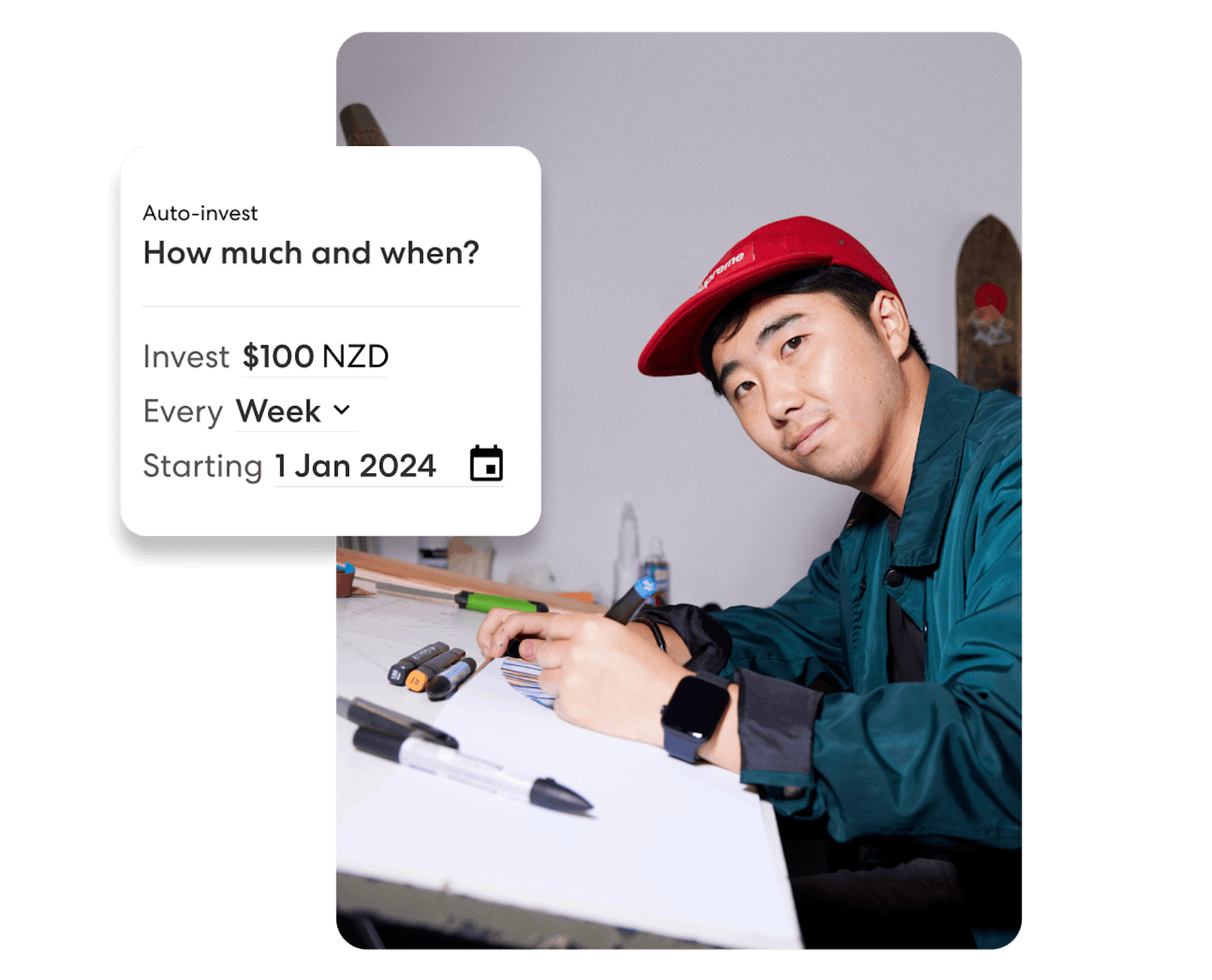

Auto-invest

Put your investing on repeat

Pick an order, the amount you want to regularly invest, and auto-invest will place the orders for you.

Let’s get started

You’ll need to be 16 or over, an NZ resident, and have an NZ bank account.

- Sign up

Have your NZ ID handy—driver license or passport is best.

- Settle in

Top up your Wallet, exchange your money, and explore the range of investments.

- Invest

With as little as 1¢, choose from over 10,000 investments across the US, Australia, and NZ.

Pricing

Keep it casual, or keep it regular

Invest when the timing is right with pay as you go, or get your transaction fees covered with a plan.

Join over 930,000 customers