Unite your wealth to work as one

Spending

Everyday spending that’s anything but

Investing

Powerful investing features

Sharesies KiwiSaver Scheme

Bring the markets to your KiwiSaver account

$12 billion+ Wealth trusted on Sharesies

930,000+ Sharesies customers in NZ and Australia

4.7/5 Average app rating based on 14k+ reviews

Crypto

Buy, hold, and sell some of the largest cryptocurrencies

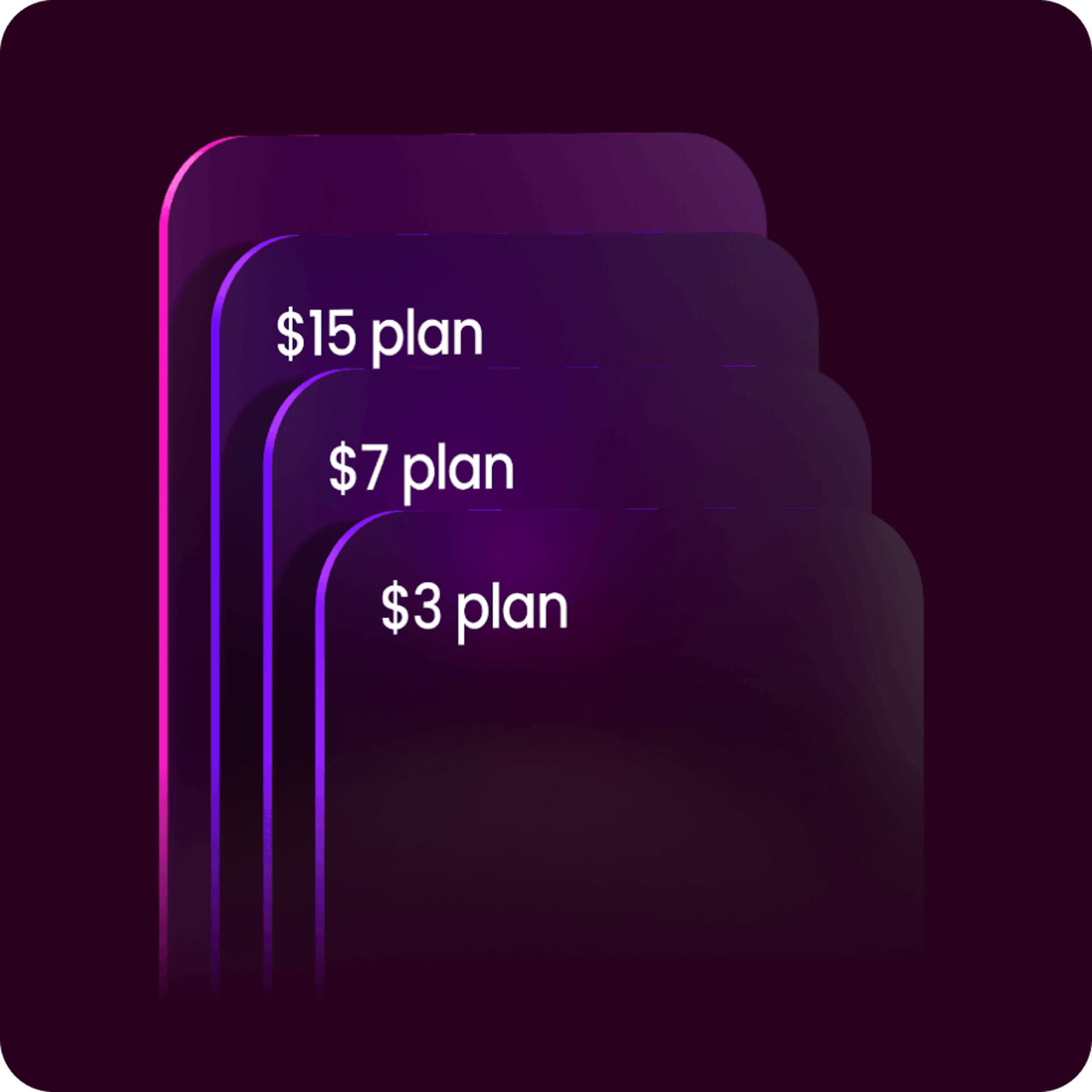

Plans

Investing regularly? A plan might help you save on fees

Sharesies PIE Save

Rate of return2.05%P.A.Subject to change. After fees, before tax.

Save & PIE Save

Save with no limits, minimums, or conditions

Join them. Join us.

Join over 930,000 Sharesies customers across New Zealand and Australia managing their wealth.