Product update: New images, more data, and simpler checkout

Since launching US shares on Sharesies, we’ve made a bunch of improvements to the way you place orders and compare info about different investments.

Get the inside skinny on these changes, the new stats we show, and why we said goodbye to everyone’s favourite koala.

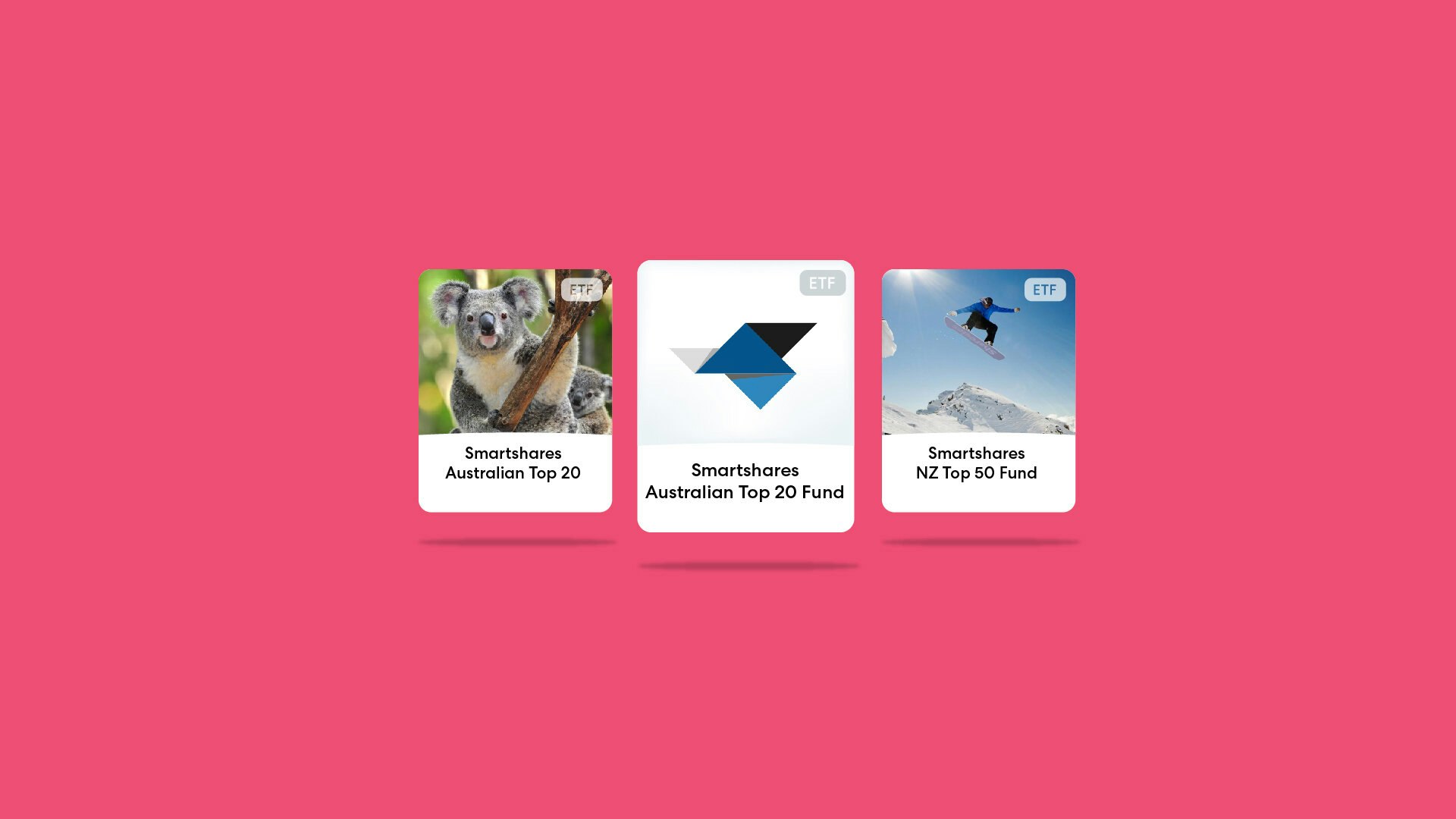

Fuzzy koala out, logos in

Recently we made the decision to change the tile imagery for our New Zealand-based exchange-traded funds (ETFs) and managed funds. Where we once had photos that represented what a fund was investing in, like a koala for a fund investing in Australian companies, we now have the fund manager’s logo.

When we first started using the imagery, we wanted to make investments feel ‘real’. In early customer research, we’d heard from newer investors that investing felt intangible, so the images were one way to show ‘you own this’. And they added a little bit of joy!

By switching to using fund managers’ logos, we wanted to make it clearer that funds are provided by fund managers (rather than Sharesies) so you could make better informed decisions. This became even more important as we began to add more investments from more fund managers. It also aligns with how we display company logos for company investments. So we made the decision to farewell the koala, and switched to the logos.

Since making the switch, we’ve heard some people miss the photos, and find it harder to spot the investment they’re looking for. So over the next few months we’ll be looking at other ways we can bring some joy back, and solve these problems with fewer unintended consequences.

More data, more (decision-making) power

For a while now, we’ve been thinking about adding extra data points to Sharesies to give you more info about an investment. But it’s a balance. Many people love Sharesies because we’re trying to simplify the investing experience and not overwhelm you with information. On the other hand, we’ve heard from investors who want to compare stats between different investments so they can choose what to invest in.

After thinking really carefully about what we’d add, and testing it with our customer research panel, we settled on two new data points.

P/E ratio

The price-to-earnings ratio (P/E ratio) is a way to compare how expensive an investment is for each dollar of profit. This is calculated by dividing the share price by earnings per share (usually for the past 12 months).

The price of an investment is typically driven by its ability to generate profits. A high P/E ratio could mean that an investment is over-valued, or that investors are expecting high growth rates in the future.

Investments with a negative P/E ratio have lost money in their last reporting year. Sometimes this is intentional, for example, early-stage companies may sacrifice profits to instead invest in growth. Or losses can be due to factors outside the company’s control, for example regulatory change, a natural disaster, outbreak of war, or a global pandemic.

Either way, investments that consistently show a negative P/E ratio aren’t generating enough money to make a profit and run the risk of bankruptcy in time. This means they’re riskier and you’ve got a higher chance of not getting your money back.

Market cap

Market capitalisation, also known as market cap, is one way to measure the size of an investment. It’s calculated by multiplying the total number of shares by the investment price.

Investments can be broken into three sizes; small-cap, mid-cap and large-cap. Generally, small-caps are thought to have more opportunity for growth, mid-caps are more stable but still have some room for growth, while large-cap companies tend to be the most stable.

Owning investments at different cap sizes is another way to increase the diversity of your Portfolio.

Why we carted off the cart

We recently removed the ability to add investments to a cart. As we were figuring out how we’d add US shares to Sharesies, it became clear that mixing orders for US and NZ investments (which are bought and sold in different currencies) in one cart was going to get real complicated, real quick!

We looked at different ways we could keep the cart functionality, like having two carts for different currencies or only allowing you to add one currency at a time. But once we tested these options, we found they were a bit clunky.

We want people to take the time to research and think about each investment carefully. By removing the cart, ordering investments in different currencies is heaps clearer, and gives you time to think about each and every investment choice you make.

We’ve heard from some people that they really miss the cart. Some people had used it as a way to keep track of things they hadn’t invested in yet, but wanted to keep an eye on. So we’ll be looking for other ways to provide these features over the next few months.

Let us know what you think!

We’re really keen to hear what you think about these changes! You can let us know your feedback, or ideas for how we can improve Sharesies, by flicking us an email at help@sharesies.co.nz.

We’ll be making more changes over the next few months! If you’d like to help us make Sharesies even better, join the research panel.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 people