From startup to our sixth birthday 🎉

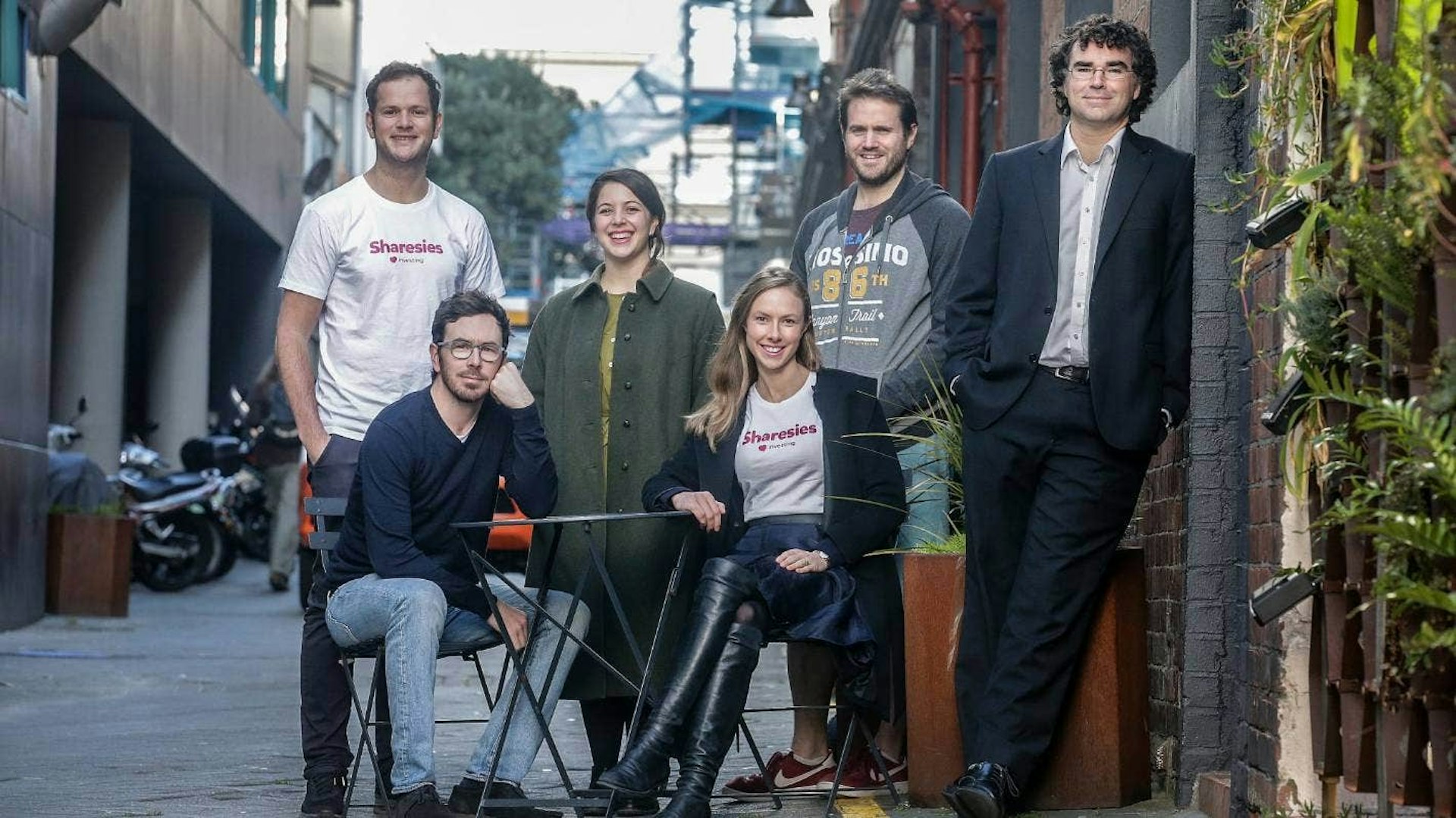

Brooke Roberts (co-founder and co-CEO) reflects on Sharesies’ journey to date, six years on from welcoming our first beta investor to the platform.

Six years ago, we welcomed our first Sharesies beta investor…well, our first investor who wasn’t a co-founder!

We have six co-founders, and as you can imagine, we all wanted to be the first Sharesies investor. Being as democratic as we are, we all put our names into a hat—and the first name we pulled out was Ben, who became the first Sharesies investor. Lucky him to have that claim to fame! 😅

A snapshot of the last six years

When we first launched Sharesies in beta, we were blown away by the response, with over 10,000 orders placed in the first seven weeks. We started with just six exchange-traded funds (ETFs)—and since then, we’ve expanded to over 8,000+ investments across NZ, AU, and the US!

Over the years, we’ve added the ability for people to invest regularly with auto-invest, financially empower the tamariki in their lives with Kids Accounts, and share the love of investing with Gifts and Refer a Friend.

We’ve busted jargon through writing a book, our Learn articles, made financial news more accessible with our Shared Lunch podcast and captured heaps of your inspiring Investor Journeys. You may have connected with us (and with each other!) through Share Club, webinars, and community events and programmes.

And if you’ve been with us for a while, you might even remember when we switched from the fruit salad to the mighty pineapple!

Where we are today

We’re a proud B Corp with over 550,000 Sharesies investors across Aotearoa and Australia who have together invested over $2.2 billion.

Recently, we levelled up the investing experience with the ability to transfer shares, opt-in to extended US trading hours, and set up price notifications, stop loss orders, and trigger buy orders.

We’ve begun partnering with listed companies to support their capital raises and corporate actions, kicked off the waitlist for the upcoming Sharesies KiwiSaver Scheme, and seen 11,813 of you already sign up and save over $31 million with our new Save accounts (which we plan to roll out to everyone over the coming months).

What’s next?

Financial empowerment still has a long way to go in Aotearoa and Australia:

In Australia, the top 1% own more wealth than the bottom 70% combined

In Aotearoa, 60% of the wealth is held by the richest 10%

40% of New Zealanders have less than $1,000 in savings

The majority of employees in Aotearoa and Australia still don’t get access to shares in the company they work for

Retail investors continue to be underestimated, undervalued, and locked out of opportunities.

We’re really driven to create more innovative and empowering experiences to help tackle these challenges. To create a future where people feel more knowledgeable and confident, and have positive relationships with money. Where everyone has access to opportunities to develop their wealth—whether that’s through investing, saving, or their KiwiSaver.

Thank you to you 💐

The road here has been super tough at times, but it’s also been incredibly rewarding and impactful. If you’re reading this, thank you so much for being part of our journey—for your interest and support, your connection to us, and for growing alongside us.

And a special shoutout to all those beta investors who took a chance and joined us six years ago! Thank you for your continued support and feedback that has helped shape Sharesies over the years.

Join over 930,000 people