Kiwis’ attitudes to financial wellbeing and investing in 2021

Our 2021 survey shows how the financial wellbeing and retirement plans of Kiwis and Sharesies investors are still being impacted by COVID-19.

2021 marks the fourth year that we’ve worked with Kantar to survey Kiwis’ attitudes towards money. We surveyed 1,001 Kiwis and an additional 685 Sharesies investors to compare and identify the differences and similarities between the two groups, asking questions around financial behaviour—including how the global pandemic has had an effect.

To summarise our key findings:

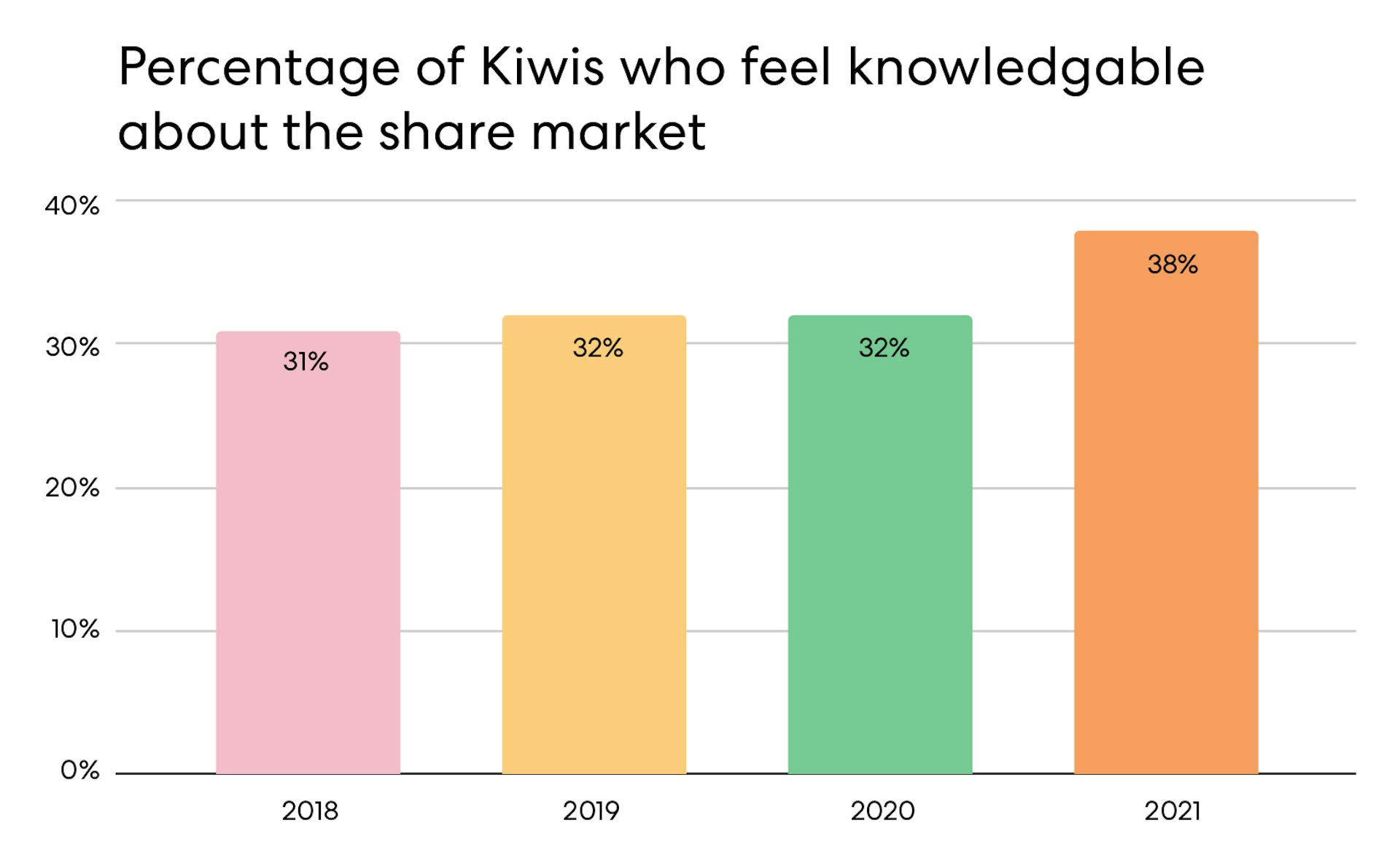

more people feel knowledgeable about the share market and investing in general compared to previous survey results, but there’s still work to do

just half of the New Zealanders we surveyed feel comfortable about their savings and current financial situation as a result of COVID-19

there’s a drop in the desire for Kiwis to own their own home

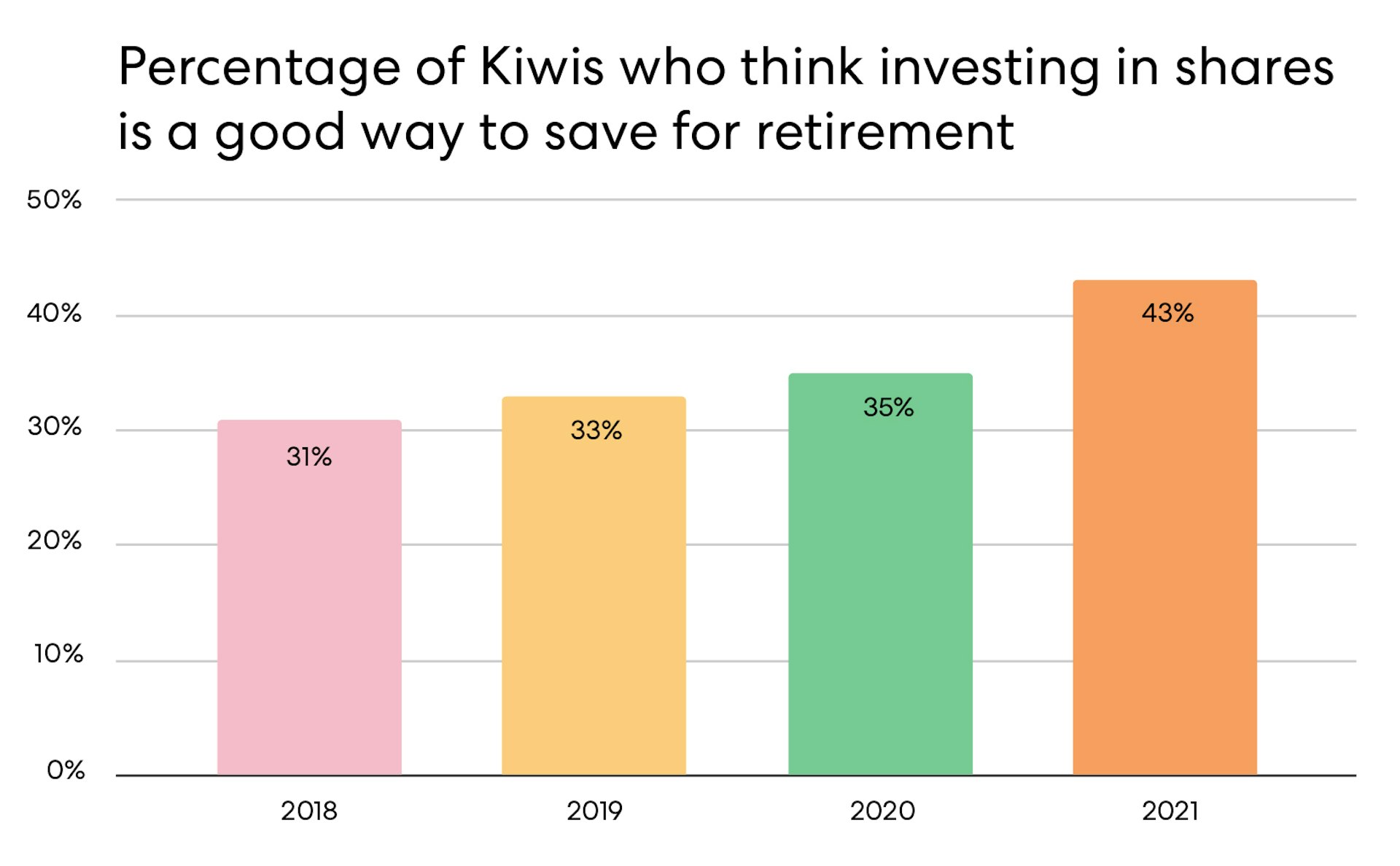

more Kiwis think that investing in shares is a good way to save for retirement.

Read on for an in-depth look at what we discovered in this year’s investor survey. Note: when we reference Kiwis or New Zealanders, we’re referring to the 1,001 participants we surveyed.

Knowledge is power

In 2020, we identified that Kiwis were keen to invest, but had a lack of knowledge to get started. Nearly three quarters (73%) of Sharesies investors in 2021 disagreed with the statement “I was given sufficient financial education through my schooling”—similar to 72% of investors last year. For the general population, 56% disagreed with this statement.

Almost half (45%) of Kiwis we surveyed feel they understand financial jargon, compared to just over half (57%) of Sharesies investors.

Diving into the gender-split, 55% of men agreed they were knowledgeable about the share market—compared to 23% of women.

There’s still heaps of work to be done in lifting investor confidence. In addition to our Learn articles, Share Club Facebook Group, Lunch Money webinars and newsletter, and our daily financial news podcast Recap, we’re always exploring new ways to educate and empower investors. Watch this space!

COVID-19 influences financial behaviour

Kiwis’ money habits have been impacted by the continued presence of the pandemic. When asked about the direct link between financial situations and the pandemic, only 46% of Aucklanders surveyed said they felt comfortable with their situation, compared to Wellingtonians (55%).

Nearly a third (31%) of Sharesies investors surveyed said they have become more aggressive with their investment strategies since the pandemic began, compared to only 9% of the general population. The general population is also less likely to have an investment strategy, with 22% not having a plan, compared to 9% of Sharesies investors.

Since the pandemic started, we found that almost half of New Zealanders (46%) never check the share markets, while three quarters (77%) of Sharesies investors claim to check the markets at least once a week.

Love affair with property is waning

It’s no secret that the housing market is unattainable for many in Aotearoa. In this year’s survey, we saw that just over a quarter (27%) of Kiwis who don’t already own a home said that they do not want to own a property. Compare this to last year, when only 12% of Kiwis were not wanting to get on the property ladder. This could be a sign that some Kiwis feel they will not be able to afford a house (23%) in 2021, compared to 16% in 2020.

Re-thinking retirement

Kiwis look to be changing their expectations about what’s required to have a comfortable retirement. We’ve seen these expectations steadily rise over the past year, with 40% of Kiwis in 2021 believing they need over $1 million, compared to 34% in 2020. The increase is similar for Sharesies investors (61%) who now believe they need $1 million for retirement, compared to (55%) last year.

While KiwiSaver has been the vehicle for retirement for many, we're seeing more people investing in shares as part of their long-term plan. Nearly half of Kiwis (43%) believe that investing in shares is a way to save for retirement, which is up from 35% in 2020.

In short

Kiwis continue to show a desire to learn about investing, and build on their financial knowledge and wellbeing. As traditional investment opportunities (like the housing market) become harder to access, more Kiwis are considering alternative ways to grow their wealth, including for retirement.

Just as the COVID-19 pandemic continues to influence the way we live, it also affects people’s financial stability—in particular, those directly impacted through extended lockdowns. The challenge to build financial literacy continues—however, the desire to invest is there, and that’s an ideal start.

To see how this year’s survey findings compare with previous years, check out the following posts:

We’d love to hear what you think of the results—get in touch via Facebook, Twitter, Instagram, or email us at help@sharesies.co.nz.🍍

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 people