Share market dip: what you need to know

Let’s look at why the markets have been up and down (but mostly down) since the start of the year, and how to prepare your portfolio for future uncertainty.

You’ve probably noticed your portfolio dip over the last few weeks. And if you’re new to investing, you might find that a bit scary. But there’s no need to panic—it’s all part of the normal ups-and-downs of investing.

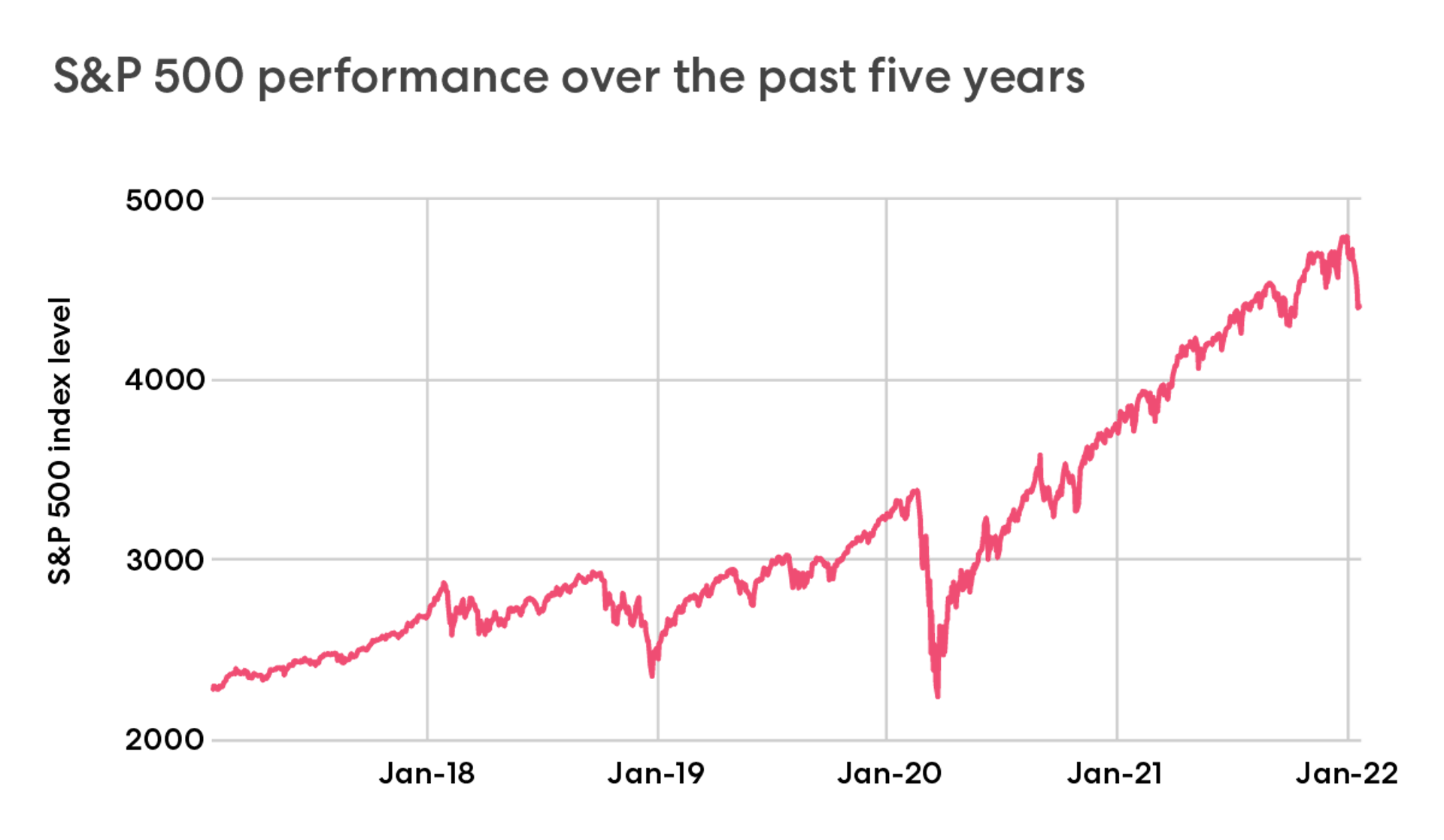

Share markets at home and abroad have been on the downward slide since the start of 2022. The S&P 500—an index tracking 500 of the largest companies listed on US stock exchanges, and a benchmark for the state of the US share market—has declined around 8% since the start of the year. Given its steady decline, some analysts say the S&P 500 is heading for a ‘market correction’ (a drop of 10% from its most recent peak).

While a drop this size over a reasonably short timeframe can come as a surprise to your portfolio, these drops are normal within share markets. Since World War II, there’ve been 27 corrections in the S&P 500, but the average annual return since the index was first started in 1926 through to 2021 is about 10.5%. And over the past 5 years, the S&P 500 index level has almost doubled:

Although past performance isn’t an indicator of future success, it’s important to keep the bigger picture in mind.

Why it’s happening

One of the main causes of the recent dip is inflation—the general rising of prices over time, which decreases how much you can buy with each dollar (as you’ve probably noticed at the supermarket checkout).

Inflation increased throughout 2021, and has continued into 2022, as central banks around the world printed enormous sums of money to keep households and businesses afloat during the pandemic. To ease inflation, the US Federal Reserve (aka ‘the Fed’) has indicated that they’re going to raise interest rates.

You might be wondering, how do interest rates affect share prices? There can be multiple factors at play, but generally, higher interest rates may make borrowing more expensive for businesses and can make a companies' future earnings look relatively less attractive (compared to a low-interest-rate environment), and this may impact company valuations.

The effect can be varied across sectors, but tends to be more pronounced for companies with higher growth prospects—which is why tech stocks in particular have been impacted this year.

What happens next

On Tuesday and Wednesday in the US, the Fed is holding one of its periodic meetings where it’ll discuss economic and financial conditions, and determine its policy—including interest rates. Afterwards (Thursday morning, NZ time), the Fed will provide an update about what’s in store for the future.

Until then—and even after the announcement—we might continue to see increased volatility in the share market while the outlook’s uncertain. As the saying goes, in the share market, anything can happen.

What it means for your portfolio

Remember that it’s entirely normal for share prices to go up and down. While you might be worried to see your portfolio go down in value, it’s important that you don’t panic.

Instead, take the opportunity to review your portfolio, and check if it’s set up for what might be a bumpy ride.

How diversified are you?

Diversification means spreading your money across lots of different types of investments to spread your risk—not just a mix of companies and funds, but investments with different levels of risk in different sectors and countries.

Shares in tech companies have been hit especially hard the past few weeks, so be sure that your portfolio includes a wide variety of investments from other sectors to provide some balance.

What’s your time horizon?

Your time horizon is the amount of time you plan to leave your money invested for.

If you’re investing for the long term, you have more time to ride out the ups and downs of the share market, and potentially nab some shares at a lower price.

If you’re thinking about selling sooner rather than later, ask yourself a few questions first:

Have you met your investment goals?

Do you need the money now?

Are you locking in a loss?

Are you missing out on growth?

Be clear about why you’re selling, and what you’ll use the money for if you do.

What’s your strategy?

There are heaps of different investing strategies out there. If your strategy was working for you in the good times, make sure to stick with it in the tough times too.

If you continue to dollar-cost average while the market is down, you might be able to buy shares at a lower price, decreasing the average cost per share over the long term.

Take a long-term view

Markets have dipped before—and they’ll probably dip again. And while no one can predict how long this dip may last, taking a long-term view means you can ride out the ups-and-downs of the share market over time.

If you’d like to learn more about the major themes and events that might shape share markets in 2022, watch (or listen to) our panel discussion below with Sharesies co-CEO Leighton Roberts, Victoria Harris, portfolio manager at Devon Funds and founder of The Curve, and John Berry, co-founder and CEO of Pathfinder Asset Management:

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 700,000 investors