Investing Insights with Tony Alexander: Investors are cautiously optimistic

Every three months, Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Below, we look at some of the key trends from Tony’s May survey.

In it for the long haul

The percentage of survey respondents who say they intend to contribute to their portfolio this year remains firm at 75%. While slightly down from 78% last quarter, this indicates that despite troubled times overseas, and wobbles in consumer and business sentiment locally, investors are still focused on the long term.

Buying shares remains the most popular type of investment. This is followed by investing in managed funds and exchange-traded funds (ETFs), as well as allocating money to saving and debt.

Property slump continues

Survey respondents intending to buy residential property sits at just 4%, compared to 11% a year ago and a peak of 17% in September 2022.

The desire to hold commercial property has also been trending down—but over a longer period. This likely reflects the combined impact of rising and higher interest rates, and revaluations of assets trending downward.

Smaller appetite for savings

During uncertain economic times in earlier surveys, we saw a firm rise in respondents intending to allocate spare money to savings accounts. This trend has eased over the past two quarters, suggesting there are better returns to be made elsewhere. The soaring markets in the US could be a factor in this.

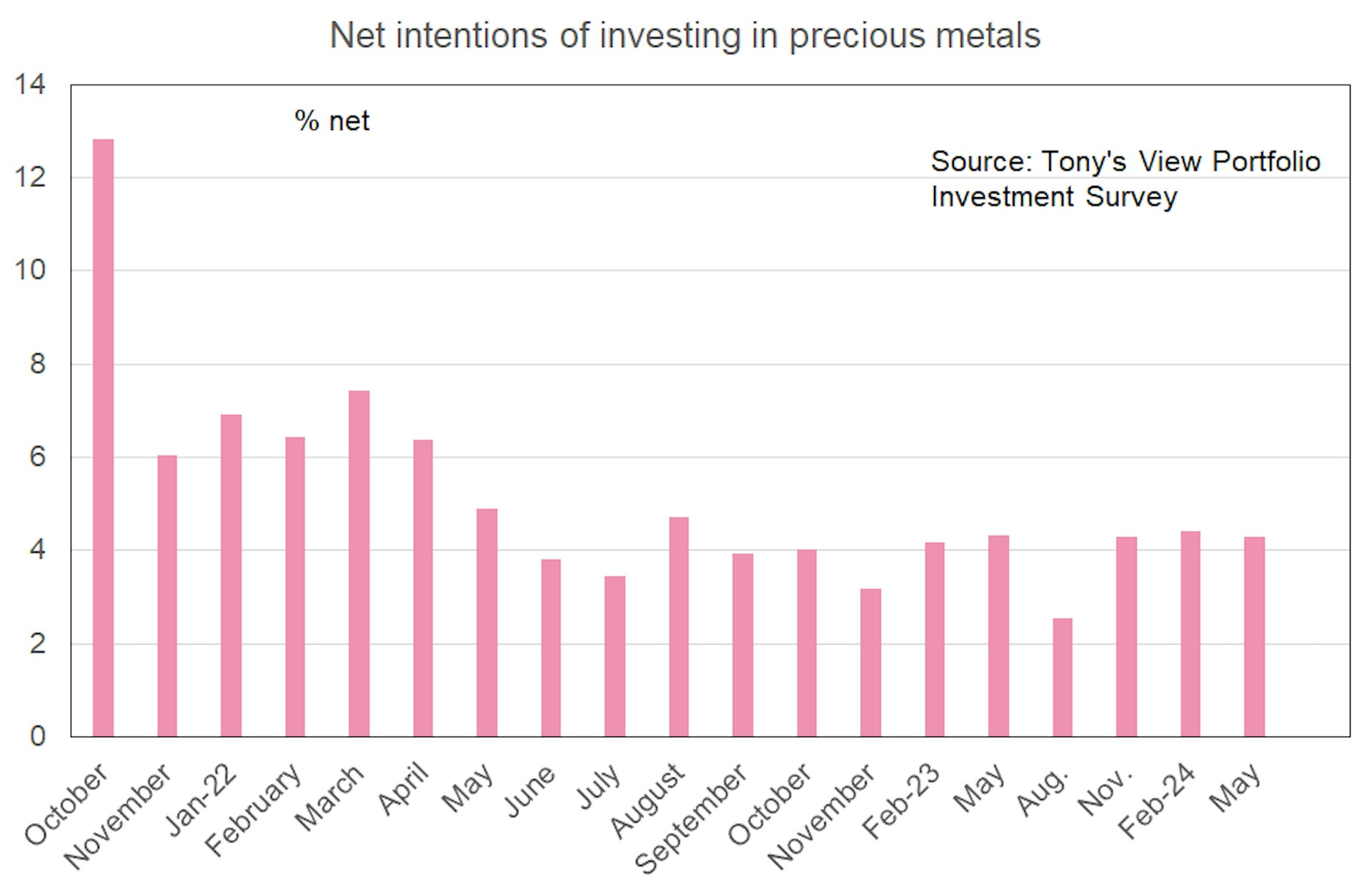

Precious metals fail to shine

Despite the price of gold and copper (common safe havens in tough economic times) reaching record highs recently, survey respondents showed only mild interest in investing in precious metals.

Download the report

For a deeper dive, download the full Investing Insights report.

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 customers