Investing Insights with Tony Alexander: Looking beyond market volatility

In the third of our monthly series, independent economist Tony Alexander finds investors are holding steady despite challenges on all fronts.

Each month, Tony surveys over 26,000 Kiwis to find out what they’re investing in and how they’re investing in it. He then analyses their responses and reports on how investment preferences are changing over time. This gives us a look into people’s thoughts on different shares, types of property, active vs passive fund management, whether to use an advisor or an app, which countries to invest in, and much more.

Below, we look at some of the key trends in Tony’s March survey.

Investors still favour shares

For the second month in a row, the proportion of survey respondents planning to boost their investments is still high at 75%.

This is in spite of the world’s financial, metals, energy, and food markets being shaken by Russia’s invasion of Ukraine, and the impact this is having on the flow of commodities (or raw materials) such as wheat.

While intentions to increase levels of investing in the next year remain strong, there’s a mild downward trend emerging. This is likely to do with the rising cost of living and less spare cash to invest.

Shares are by far the most popular asset class to buy. Though, even with house prices falling, 13% of investors plan to buy residential property and fewer plan to sell.

Hanging in there

High volatility in share markets has not changed the view of investors to hold shares of the long-term.

Intentions to buy crypto have stabilised after dropping away last month, possibly because of a rebound in some prices. The crypto market also got a boost after US President Joe Biden ordered government agencies to look at regulating digital currencies.

There was a slight lift in people opting to select shares themselves rather than invest in a fund. In contrast, there continues to be a downward trend in people intending to invest in KiwiSaver funds.

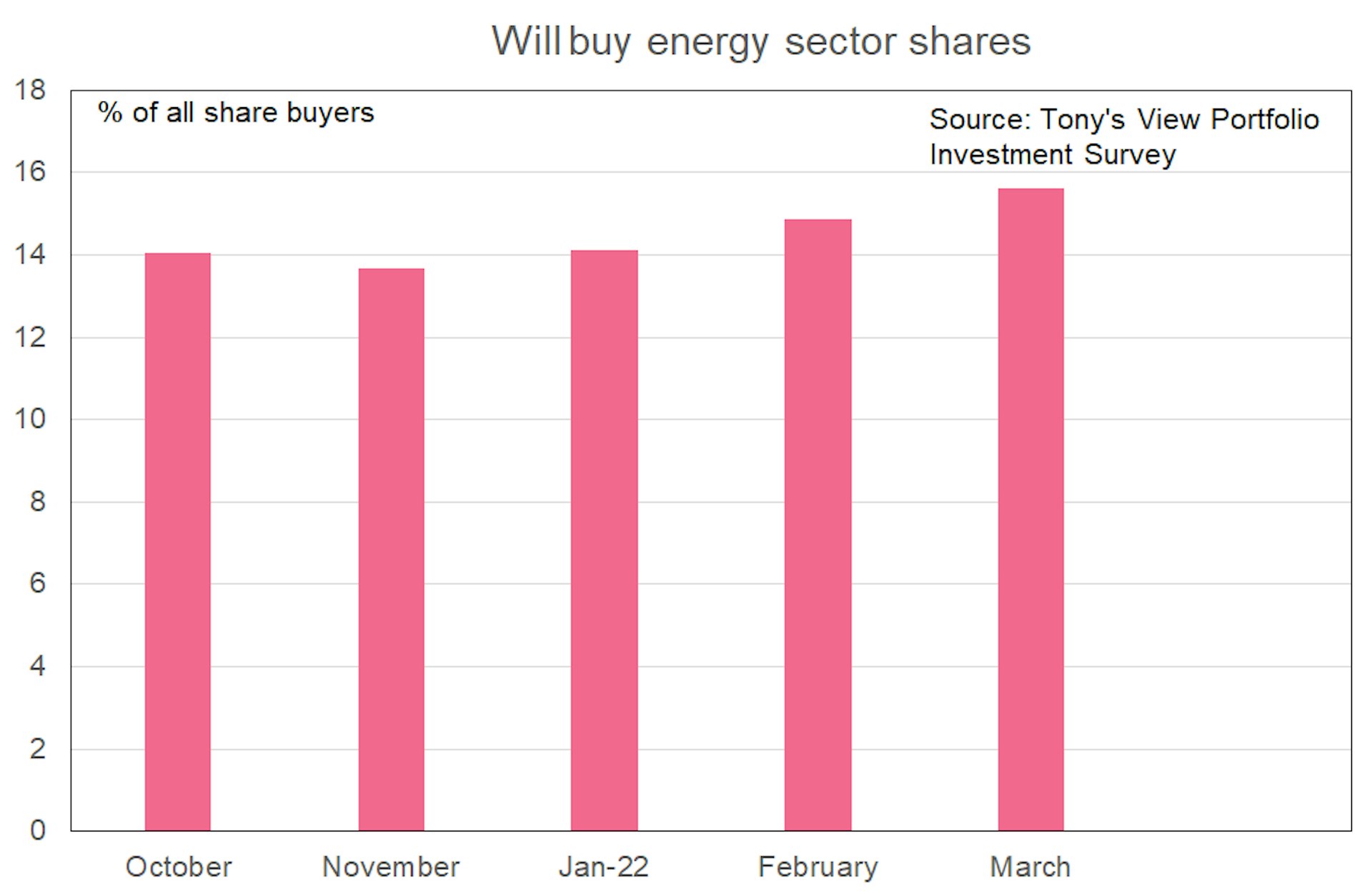

Energy and Aussie shares

There’s a slight upward trend in investing in the energy sector. This is likely to reflect the jump in international oil prices, and an anticipated swing to investment in renewables.

While there’s no trend towards shying away from investing in New Zealand assets, there’s a bit more interest in Australian shares.

As in previous months, the majority of people investing in managed funds are opting for growth and aggressive portfolios.

Download the report

For a deeper dive, download the full Investing Insights report for March 2022 [PDF, 1.53 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 people