Investing Insights with Tony Alexander: Moving back into shares

Tony’s first survey of 2023 finds that investors are more optimistic about buying shares in various forms despite concerns about economic headwinds.

Each quarter, Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Below, we look at some of the key trends in Tony’s latest survey.

Dipping their toe back in

Some recent evidence that inflation has slowed led to investors being more willing to invest. This is in contrast to the last three months, where investors appeared to be spooked by inflation reaching 7.2% and the subsequent sharp rise in interest rates.

What investors are buying

In February shares, managed funds, and exchange traded funds (ETFs) were back on the buy list. The intention to invest in these assets has risen since the November 2022 survey. In fact, the net proportion of investors planning to buy is the second highest since the survey started.

Buying shares in individual companies remains the most popular as the graph below shows:

Property takes a back seat

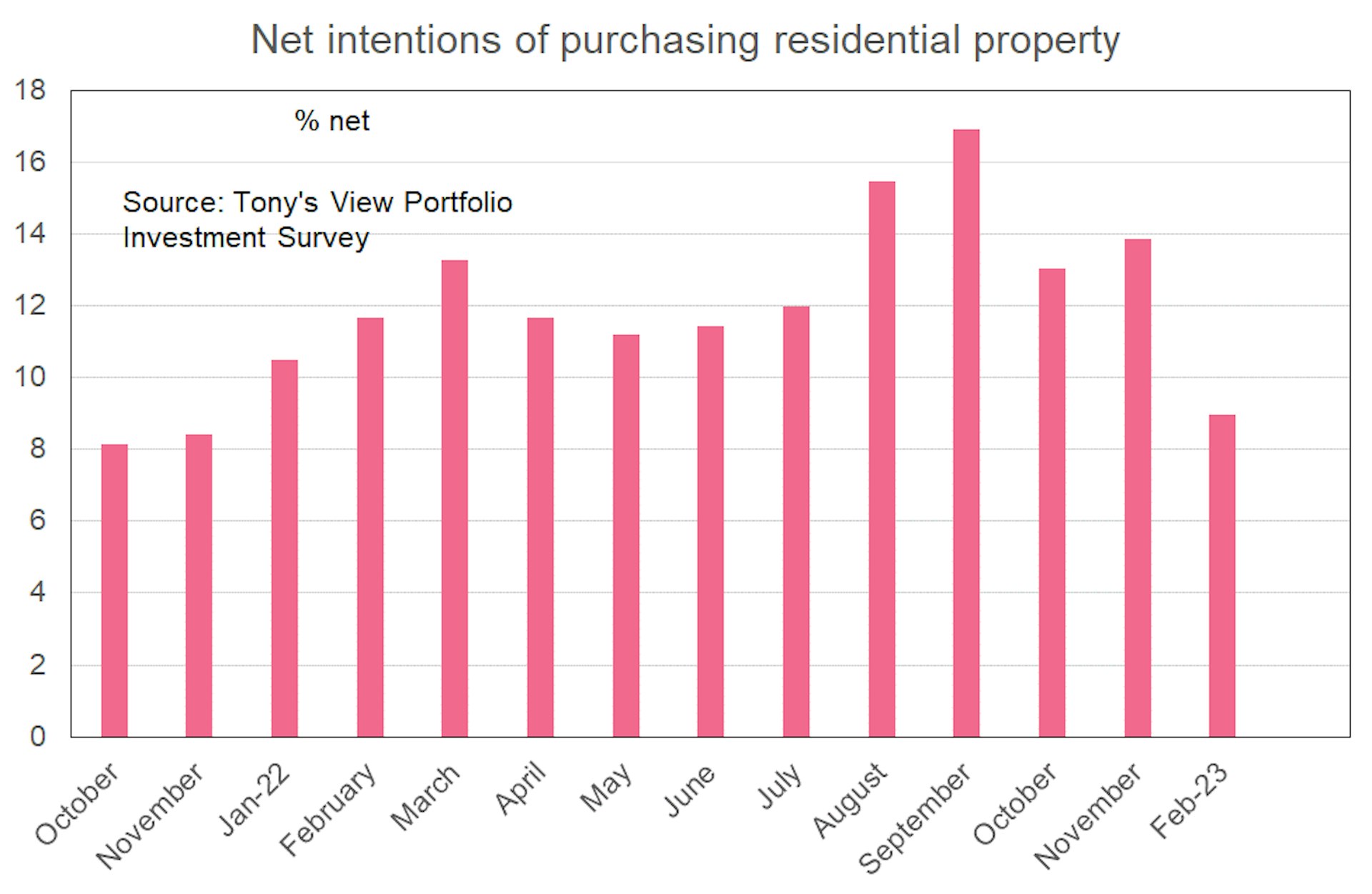

House buying intentions are at their lowest since the survey started late in 2021. Intensions peaked in September 2022 when the proportion of investors saying they might buy was 32%. This has since dropped to 9% in February 2023.

Fixed interest assets

February’s survey shows that investors have higher intentions to pay off their debts and put money in a savings account. Higher interest rates on simple investments (like bank accounts) have risen sharply from record lows, meaning banks should find it easier to secure deposits.

What’s weighing on investors’ minds

In a new survey section, investors were asked if they’re concerned about their investment returns.

A group of people said that because their focus is on the long-term and not the next 12 years, they’re not concerned about issues they expect to be short-lived, such as inflation, high interest rates, and geo-political uncertainty.

Of those who did express concern, 17% cited inflation, followed closely by 16% who were concerned about a New Zealand recession, and 15% who were worried about high interest rates.

Download the report

For a deeper dive, download the full Investing Insights report [PDF, 1 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 customers