Investing Insights with Tony Alexander: Proceeding with caution

In October’s report, independent economist Tony Alexander finds investors are taking a cautious approach amid widespread uncertainty, with more planning to park their money in savings accounts.

Each month, Tony surveys over 28,000 Kiwis to find out what they’re investing in and how they’re investing in it. He then analyses their responses and reports on how investment preferences are changing over time. This gives us a look into people’s thoughts on different shares, types of property, active vs passive fund management, whether to use an advisor or an app, which countries to invest in, and much more.

Below, we look at some of the key trends in Tony’s October survey.

Wait and see

Amid higher-than-expected inflation, interest rate hikes, a deteriorating world economy, and continued volatility in share markets, investors have grown more cautious about increasing their risk exposure.

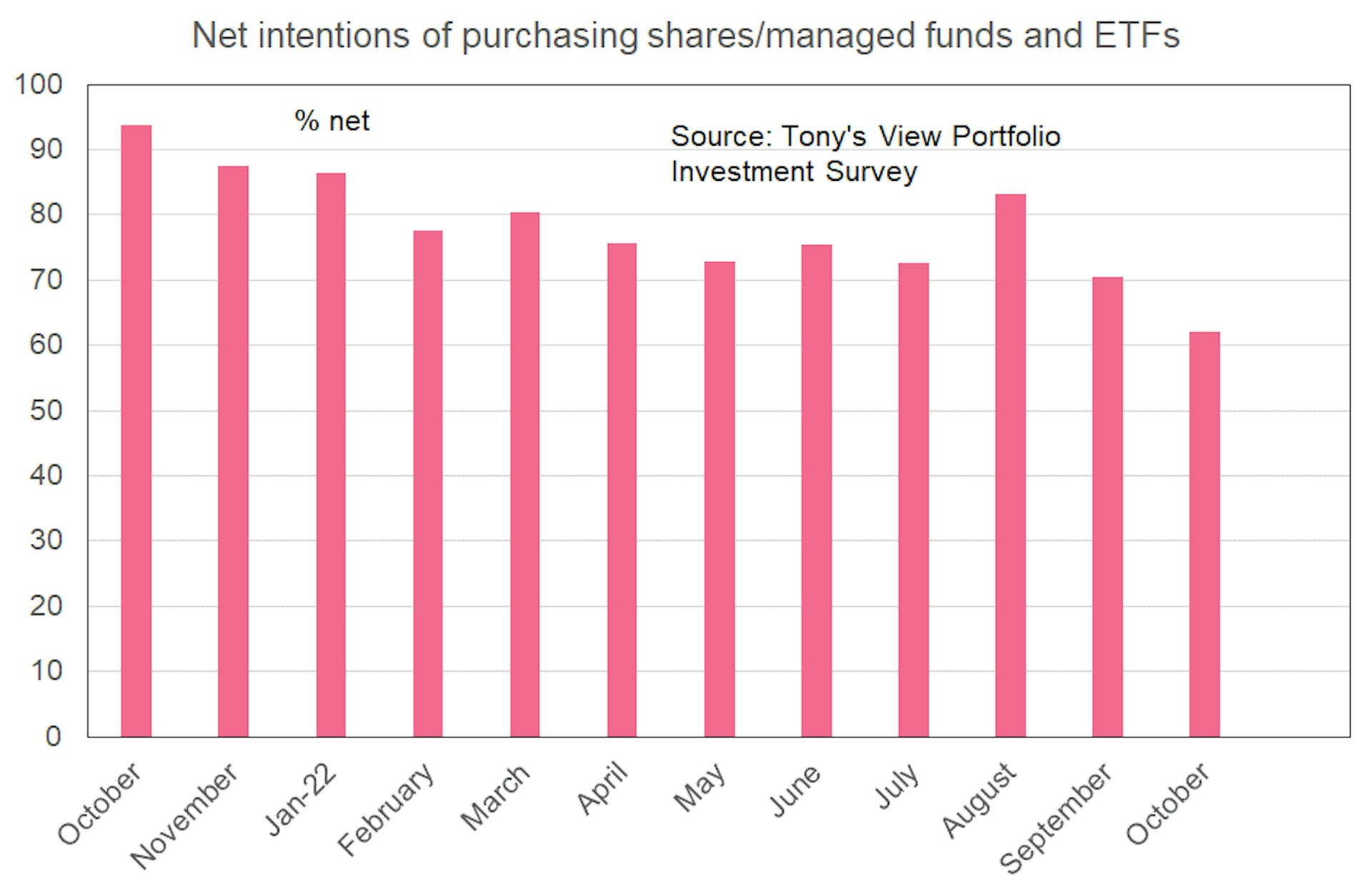

Fewer are planning to buy shares over the coming year, with net intentions of purchasing shares falling to 61% of respondents in October.

Short-lived home run

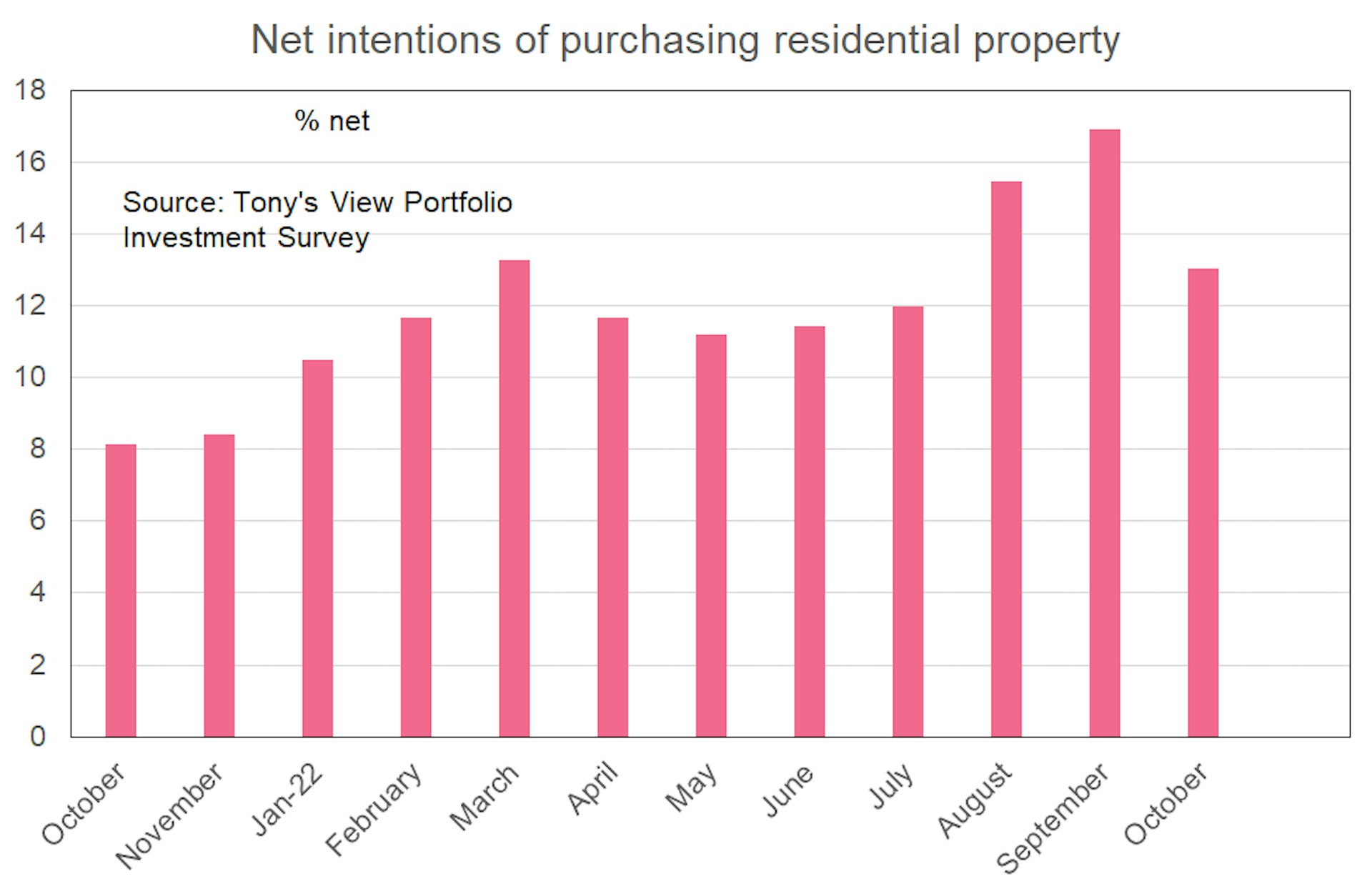

This more cautious outlook has also weighed on plans to invest in residential property, which had looked on the cusp of a recovery in the last couple of surveys. It seems that investors are not quickly following first home buyers back into the residential property market, like they did in the early days of the pandemic.

Cashing in

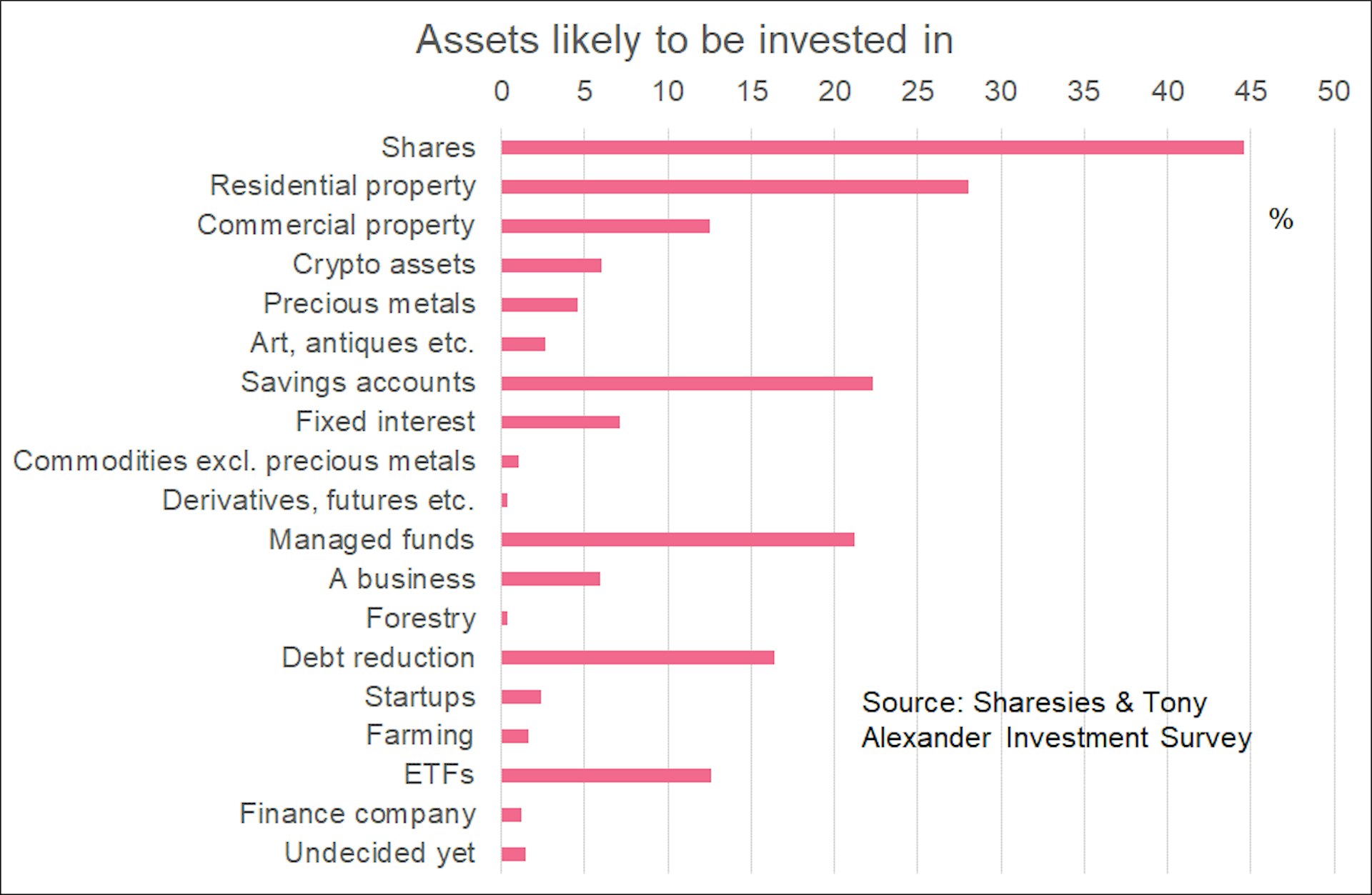

Shares remain the most preferred investment by some stretch. However, there’s been a notable jump in the proportion of investors who plan to put their money in a savings account compared to previous surveys.

Download the report

For a deeper dive, download the full Investing Insights report for October 2022 [PDF, 1.19 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 people